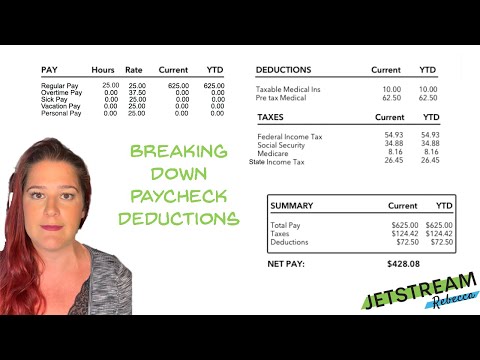

The amount taken out is based on your gross income, your W-4 Form, which describes your tax situation for your employer, and a variety of other factors. Other federal deductions fund Social Security and Medicare, which are part of the federal health care system for the aged and other groups.

Q. How much a year is 8 an hour?

Converting $8 an hour in another time unit

Table of Contents

| Conversion | Unit |

|---|---|

| Yearly salary | $8 an hour is $15,600 per year |

| Monthly salary | $8 an hour is $1,300 per month |

| Biweekly salary | $8 an hour is $600 per 2 weeks |

| Weekly salary | $8 an hour is $300 per week |

Q. How much is your check if you make 8.50 an hour?

$8.50 per hour working 2,000 hours In this case, you can quickly compute the annual salary by multiplying the hourly wage by 2000. Your hourly pay of $8.50 is then equivalent to an average annual income of $17,000 per year.

Q. How do I calculate how much I get paid?

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Q. How much money does the government take from paycheck?

Overview of California Taxes

| Gross Paycheck | $3,146 | |

|---|---|---|

| Federal Income | 15.32% | $482 |

| State Income | 5.07% | $159 |

| Local Income | 3.50% | $110 |

| FICA and State Insurance Taxes | 7.80% | $246 |

Q. What are the top 3 states to retire?

Main Findings

| Overall Rank | State | Total Score |

|---|---|---|

| 1 | Florida | 61.09 |

| 2 | Colorado | 60.94 |

| 3 | Delaware | 58.69 |

| 4 | Virginia | 58.61 |