Not only was the 2008 election the first time since 1952 that neither the incumbent president nor the incumbent vice president was a candidate in the general election, but it was also the first time since the 1928 election that neither sought his party’s nomination for president; as Bush was term-limited from seeking …

Q. Who raised more money in 2008 election?

Fundraising for the 2008 United States presidential election

Table of Contents

- Q. Who raised more money in 2008 election?

- Q. How much did the 2008 presidential candidates spend on their campaigns?

- Q. Can a presidential candidate use their own money for campaign?

- Q. Who pays for a presidential campaign?

- Q. How much can you donate to your own campaign?

- Q. What is a 527?

- Q. Is a 527 a PAC?

- Q. Is Pac tax exempt?

- Q. What is a 501 charity?

- Q. What is the difference between a 501c3 and a 501 C 8?

- Q. What can a 501c3 not do?

- Q. What taxes are 501c3 exempt from?

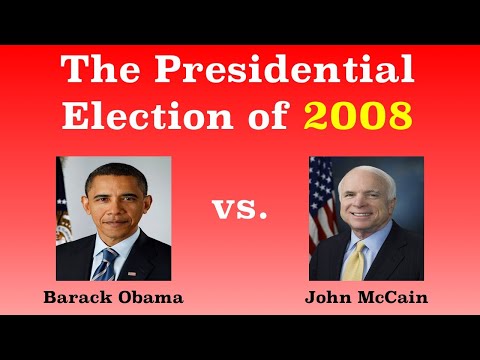

| Candidate (party) | Amount raised | Votes |

|---|---|---|

| Barack Obama (D) | $778,642,962 | 69,498,215 |

| John McCain (R) | $383,913,834 | 59,948,240 |

| Ralph Nader (I) | $4,496,180 | 738,720 |

| Bob Barr (L) | $1,383,681 | 523,713 |

Q. How much did the 2008 presidential candidates spend on their campaigns?

Individuals, parties and other groups spent $168.8 million independently advocating the election or defeat of presidential candidates during the 2008 campaign.In the three previous cycles, similar spending totaled $192.4 million, $14.7 million, and $1.4 million, respectively.

Q. Can a presidential candidate use their own money for campaign?

Using the personal funds of the candidate. When candidates use their personal funds for campaign purposes, they are making contributions to their campaigns. Unlike other contributions, these candidate contributions are not subject to any limits. They must, however, be reported.

Q. Who pays for a presidential campaign?

Under the presidential public funding program, eligible presidential candidates receive federal government funds to pay for the qualified expenses of their political campaigns in both the primary and general elections.

Q. How much can you donate to your own campaign?

Federal contribution limits

| DONORS | RECIPIENTS | |

|---|---|---|

| Candidate Committee | Additional National Party Committee Accounts | |

| Individual | $2,800 per election | $106,500 per account, per year |

| Candidate Committee | $2,000 per election | |

| PAC – Multicandidate | $5,000 per election | $45,000 per account, per year |

Q. What is a 527?

A 527 organization or 527 group is a type of U.S. tax-exempt organization organized under Section 527 of the U.S. Internal Revenue Code (26 U.S.C. § 527). A 527 group is created primarily to influence the selection, nomination, election, appointment or defeat of candidates to federal, state or local public office.

Q. Is a 527 a PAC?

The Section 527 Political Action Committee (527 PAC) in conjunction with Political Organization and Filing Disclosure (POFD) is an Internal Revenue Service (IRS) application controlled under the IRS TEGE Business Unit.

Q. Is Pac tax exempt?

Political parties; campaign committees for candidates for federal, state or local office; and political action committees are all political organizations subject to tax under IRC section 527 and may have filing requirements with the Service.

Q. What is a 501 charity?

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code Section 501(c) (26 U.S.C. § 501(c)) and is one of over 29 types of nonprofit organizations exempt from some federal income taxes.

Q. What is the difference between a 501c3 and a 501 C 8?

These organizations are therefore tax-exempt, although unlike Section 501(c)(3) organizations, they are not qualified to receive tax-deductible contributions unless such contributions are to be used exclusively for religious, charitable, scientific, literary, or educational purposes, or for the prevention of cruelty to …

Q. What can a 501c3 not do?

Political activity. All section 501(c)(3) organizations are prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate running for public office. The prohibition applies to all campaigns (federal, state and local level).

Q. What taxes are 501c3 exempt from?

Nonprofits are also exempt from paying sales tax and property tax. While the income of a nonprofit organization may not be subject to federal taxes, nonprofit organizations do pay employee taxes (Social Security and Medicare) just like any for-profit company.