MAD (a=0.3) = 372.8 / 5 = 74.56 MAD(a=0.6) = 259 / 5 = 51.8 MAD( a=0.9) = 190.5 / 5= 38.1 Because it has the lowest MAD, the smoothing constant a=0.9 gives the most accurate forecast.

Q. What is the advantage of exponential smoothing over moving average?

The advantage of the exponential moving average is that by being weighted to the most recent price changes, it responds more quickly to price changes than the SMA does.

Table of Contents

- Q. What is the advantage of exponential smoothing over moving average?

- Q. Why is exponential smoothing bad?

- Q. What is a big advantage of exponential smoothing?

- Q. What does Alpha mean in exponential smoothing?

- Q. Why do companies use exponential smoothing?

- Q. What is level in exponential smoothing?

- Q. How do you calculate double exponential smoothing?

- Q. What is double exponential smoothing used for?

- Q. What is double exponential smoothing method?

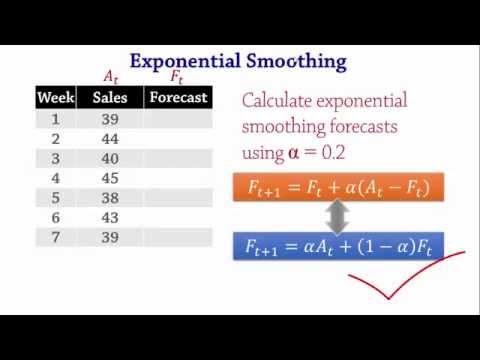

- Q. How do you solve exponential smoothing forecasts?

- Q. What is the formula of exponential smoothing?

- Q. What are smoothing techniques?

- Q. How do you choose exponential smoothing parameters?

- Q. What is the sum of weights in exponential smoothing?

- Q. How do you determine the best alpha for exponential smoothing?

- Q. How do you choose a smoothing constant?

- Q. What is smoothing coefficient?

- Q. How do you choose the right alpha for exponential smoothing?

Q. Why is exponential smoothing bad?

Demerits: Exponential smoothing will lag. In other words, the forecast will be behind, as the trend increases or decreases over time. Exponential smoothing will fail to account for the dynamic changes at work in the real world, and the forecast will constantly require updating to respond new information.

Q. What is a big advantage of exponential smoothing?

The exponential smoothing method takes this into account and allows for us to plan inventory more efficiently on a more relevant basis of recent data. Another benefit is that spikes in the data aren’t quite as detrimental to the forecast as previous methods.

Q. What does Alpha mean in exponential smoothing?

ALPHA is the smoothing parameter that defines the weighting and should be greater than 0 and less than 1. ALPHA equal 0 sets the current smoothed point to the previous smoothed value and ALPHA equal 1 sets the current smoothed point to the current point (i.e., the smoothed series is the original series).

Q. Why do companies use exponential smoothing?

Using exponential smoothing to predict your future sales will give you the data you need to make the best decisions in every area of your company. As such, we think using the exponential smoothing forecasting method provides you with the data you need to make the best decisions in every area of your company.

Q. What is level in exponential smoothing?

Double exponential smoothing employs a level component and a trend component at each period. It uses two weights, or smoothing parameters, to update the components at each period. The double exponential smoothing equations are: L t = α Y t + (1 – α) [L t-1 + T t-1] T t = γ[L t – L t-1] + (1 – γ) T.

Q. How do you calculate double exponential smoothing?

Time Series with Trend: Double Exponential Smoothing

- Ft = a* At-1 + (1- a) * (Ft-1 + Tt-1)

- Tt = b* (At-1-Ft-1) + (1- b) * Tt-1.

- AFt = Ft + Tt.

Q. What is double exponential smoothing used for?

Use Double Exponential Smoothing as a general smoothing method and to provide short-term forecasts when your data have a trend and do not have a seasonal component. This procedure calculates dynamic estimates for two components: level and trend.

Q. What is double exponential smoothing method?

Double exponential smoothing employs a level component and a trend component at each period. Double exponential smoothing uses two weights, (also called smoothing parameters), to update the components at each period.

Q. How do you solve exponential smoothing forecasts?

The exponential smoothing calculation is as follows: The most recent period’s demand multiplied by the smoothing factor. The most recent period’s forecast multiplied by (one minus the smoothing factor). S = the smoothing factor represented in decimal form (so 35% would be represented as 0.35).

Q. What is the formula of exponential smoothing?

This method is used for forecasting the time series when the data has both linear trend and seasonal pattern. This method is also called Holt-Winters exponential smoothing. The sales of a magazine in a stall for the previous 10 months are given below….Triple exponential smoothing.

| Month | Sales |

|---|---|

| October | 45 |

Q. What are smoothing techniques?

Smoothing data removes random variation and shows trends and cyclic components. Inherent in the collection of data taken over time is some form of random variation. There exist methods for reducing of canceling the effect due to random variation. An often-used technique in industry is “smoothing”.

Q. How do you choose exponential smoothing parameters?

When choosing smoothing parameters in exponential smoothing, the choice can be made by either minimizing the sum of squared one-step-ahead forecast errors or minimizing the sum of the absolute one- step-ahead forecast errors. In this article, the resulting forecast accuracy is used to compare these two options.

Q. What is the sum of weights in exponential smoothing?

Table 7.1 shows the weights attached to observations for four different values of αα when forecasting using simple exponential smoothing. Note that the sum of the weights even for a small αα will be approximately one for any reasonable sample size.

Q. How do you determine the best alpha for exponential smoothing?

We choose the best value for /alpha so the value which results in the smallest MSE. The sum of the squared errors (SSE) = 208.94. The mean of the squared errors (MSE) is the SSE /11 = 19.0. The MSE was again calculated for /alpha = 0.5 and turned out to be 16.29, so in this case we would prefer an /alpha of 0.5.

Q. How do you choose a smoothing constant?

A different way of choosing the smoothing constant: for each value of α, a set of forecasts is generated using the appropriate smoothing procedure. These forecasts are compared with the actual observations in the time series and the value of a that gives the smallest sum of squared forecast errors is chosen.

Q. What is smoothing coefficient?

The smoothing coefficient α is a value between 0 and 1. A small value of, say, between 0.05 and 0.10 results in a high degree of smoothing and has the same effect as a large number of observations in a moving average calculation.