Compound interest method: Compounding of interest is very common. Under this method, the interest is charged on principal plus any accumulated interest. The amount of interest for a period is added to the amount of principal to compute the interest for next period.

Table of Contents

- Q. Is compound interest earned on principal and interest?

- Q. What is compound interest investment?

- Q. What is compound interest with example?

- Q. What is the principal in compound interest?

- Q. What is principal amount with example?

- Q. What is the formula of principal?

- Q. How do you calculate interest with time and principal?

- Q. What is the formula of principal amount?

- Q. How do you calculate principal and interest payments?

- Q. How do you calculate principal in simple interest?

- Q. How do I calculate an interest rate?

- Q. How do you calculate total interest paid on a loan?

- Q. How do you calculate interest per month?

- Q. How do you calculate interest earned on a savings account?

- Q. How much interest will 1000 earn in a savings account?

- Q. How does interest work on savings account?

- Q. How often is interest paid on savings account?

- Q. Do you have to pay tax on interest from savings account?

- Q. Can you lose money in a savings account?

- Q. How much money should you keep in your savings account?

- Q. Is it better to keep money in checking or savings?

- Q. Should I keep money in savings or invest?

- Q. How do I calculate compound interest?

- Q. What is the difference between simple interest and compound interest?

- Q. How do u calculate interest?

- Q. How is principal and EMI calculated?

- Q. What is the principal of a loan?

- Q. What gets paid first principal or interest?

- Q. Is it principle or principal on a loan?

- Q. What happens if I pay principal only?

- Q. Is it better to refinance or just pay extra principal?

- Q. Can you pay off principal before interest?

- Q. Is it better to put extra money towards escrow or principal?

- Q. What happens if I pay an extra 00 a month on my mortgage?

- Q. Why am I paying more interest than principal car?

- Q. Do extra car payments go to principal?

- Q. Do large principal payments reduce monthly payments?

- Q. What is the highest interest rate on a car loan by law?

- Q. What is the highest legal interest rate?

- Q. What is a high car interest rate?

Q. Is compound interest earned on principal and interest?

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

Table of Contents

- Q. Is compound interest earned on principal and interest?

- Q. What is compound interest investment?

- Q. What is compound interest with example?

- Q. What is the principal in compound interest?

- Q. What is principal amount with example?

- Q. What is the formula of principal?

- Q. How do you calculate interest with time and principal?

- Q. What is the formula of principal amount?

- Q. How do you calculate principal and interest payments?

- Q. How do you calculate principal in simple interest?

- Q. How do I calculate an interest rate?

- Q. How do you calculate total interest paid on a loan?

- Q. How do you calculate interest per month?

- Q. How do you calculate interest earned on a savings account?

- Q. How much interest will 1000 earn in a savings account?

- Q. How does interest work on savings account?

- Q. How often is interest paid on savings account?

- Q. Do you have to pay tax on interest from savings account?

- Q. Can you lose money in a savings account?

- Q. How much money should you keep in your savings account?

- Q. Is it better to keep money in checking or savings?

- Q. Should I keep money in savings or invest?

- Q. How do I calculate compound interest?

- Q. What is the difference between simple interest and compound interest?

- Q. How do u calculate interest?

- Q. How is principal and EMI calculated?

- Q. What is the principal of a loan?

- Q. What gets paid first principal or interest?

- Q. Is it principle or principal on a loan?

- Q. What happens if I pay principal only?

- Q. Is it better to refinance or just pay extra principal?

- Q. Can you pay off principal before interest?

- Q. Is it better to put extra money towards escrow or principal?

- Q. What happens if I pay an extra 00 a month on my mortgage?

- Q. Why am I paying more interest than principal car?

- Q. Do extra car payments go to principal?

- Q. Do large principal payments reduce monthly payments?

- Q. What is the highest interest rate on a car loan by law?

- Q. What is the highest legal interest rate?

- Q. What is a high car interest rate?

Q. What is compound interest investment?

Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested, earning you more interest. As a wise man once said, “Money makes money. And the money that money makes, makes money.” Compound interest accelerates the growth of your savings and investments over time.

Q. What is compound interest with example?

Example. If an amount of $5,000 is deposited into a savings account at an annual interest rate of 5%, compounded monthly, with additional deposits of $100 per month (made at the end of each month). The value of the investment after 10 years can be calculated as follows… P = 5000. PMT = 100.

Q. What is the principal in compound interest?

P = principal amount (the initial amount you borrow or deposit) r = annual rate of interest (as a decimal) t = number of years the amount is deposited or borrowed for. A = amount of money accumulated after n years, including interest.

Q. What is principal amount with example?

In the context of borrowing, principal is the initial size of a loan; it can also be the amount still owed on a loan. If you take out a $50,000 mortgage, for example, the principal is $50,000. If you pay off $30,000, the principal balance now consists of the remaining $20,000.

Q. What is the formula of principal?

Principal Amount Formulas We can rearrange the interest formula, I = PRT to calculate the principal amount. The new, rearranged formula would be P = I / (RT), which is principal amount equals interest divided by interest rate times the amount of time.

Q. How do you calculate interest with time and principal?

Simple Interest Formulas and Calculations:

- Calculate Interest, solve for I. I = Prt.

- Calculate Principal Amount, solve for P. P = I / rt.

- Calculate rate of interest in decimal, solve for r. r = I / Pt.

- Calculate rate of interest in percent. R = r * 100.

- Calculate time, solve for t. t = I / Pr.

Q. What is the formula of principal amount?

The formula for calculating Principal amount would be P = I / (RT) where Interest is Interest Amount, R is Rate of Interest and T is Time Period.

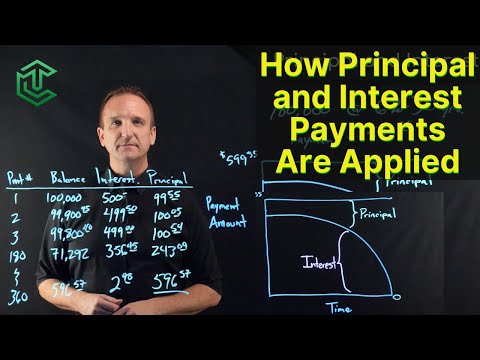

Q. How do you calculate principal and interest payments?

Simple Interest Formulas and Calculations:

- Calculate Total Amount Accrued (Principal + Interest), solve for A. A = P(1 + rt)

- Calculate Principal Amount, solve for P. P = A / (1 + rt)

- Calculate rate of interest in decimal, solve for r. r = (1/t)(A/P – 1)

- Calculate rate of interest in percent.

- Calculate time, solve for t.

Q. How do you calculate principal in simple interest?

Use this simple interest calculator to find A, the Final Investment Value, using the simple interest formula: A = P(1 + rt) where P is the Principal amount of money to be invested at an Interest Rate R% per period for t Number of Time Periods. Where r is in decimal form; r=R/100; r and t are in the same units of time.

Q. How do I calculate an interest rate?

How to calculate interest rate

- Step 1: To calculate your interest rate, you need to know the interest formula I/Pt = r to get your rate.

- I = Interest amount paid in a specific time period (month, year etc.)

- P = Principle amount (the money before interest)

- t = Time period involved.

- r = Interest rate in decimal.

Q. How do you calculate total interest paid on a loan?

Simple interest

- Gather information like your principal loan amount, interest rate and total number of months or years that you’ll be paying the loan.

- Calculate your total interest by using this formula: Principal Loan Amount x Interest Rate x Time (aka Number of Years in Term) = Interest.

Q. How do you calculate interest per month?

To calculate the monthly interest, simply divide the annual interest rate by 12 months. The resulting monthly interest rate is 0.417%. The total number of periods is calculated by multiplying the number of years by 12 months since the interest is compounding at a monthly rate.

Q. How do you calculate interest earned on a savings account?

With compound interest, the account provider calculates interest and adds it to the balance several times per year (usually daily or weekly). If interest is compounded daily, divide the simple interest rate by 365 and multiply the result by the balance in the account to find the interest earned in one day.

Q. How much interest will 1000 earn in a savings account?

How much interest can you earn on $1,000? If you’re able to put away a bigger chunk of money, you’ll earn more interest. Save $1,000 for a year at 0.01% APY, and you’ll end up with $1,000.10. If you put the same $1,000 in a high-yield savings account, you could earn about $5 after a year.

Q. How does interest work on savings account?

Suppose you deposit $5,000 into a savings account, don’t deposit or withdraw any more money and the interest rate doesn’t change. If the account has a 1.00% interest rate and the interest compounds annually—that is, the bank pays you interest on your balance once each year—you’ll earn $50 after the first year.

Q. How often is interest paid on savings account?

With most savings accounts and money market accounts, you’ll earn interest every day, but interest is typically paid to the account monthly. However, CDs usually pay you at the end of the specific term. If you aren’t sure of when your account earns interest, it may be time to call your bank.

Q. Do you have to pay tax on interest from savings account?

Any interest earned on a savings account is taxable income. Interest from a savings account is considered an addition to your taxable income for the year in which it is paid.

Q. Can you lose money in a savings account?

Yes, savings account over a long period of time can lose you money. You may have the physical cash but the purchasing power of that cash has diminished and there is nothing any of us can do about it. Inflation is actually a good thing when it is balanced and so far, it is just a fact of life that isn’t going anywhere.

Q. How much money should you keep in your savings account?

Most financial experts end up suggesting you need a cash stash equal to six months of expenses: If you need $5,000 to survive every month, save $30,000. Personal finance guru Suze Orman advises an eight-month emergency fund because that’s about how long it takes the average person to find a job.

Q. Is it better to keep money in checking or savings?

Savings Account. Aim for about one to two months’ worth of living expenses in checking, and another three to six months’ worth in savings. Money in a checking account is easy to access, and keeping balances above the bare minimum can help you avoid monthly maintenance fees.

Q. Should I keep money in savings or invest?

Saving money should almost always come before investing money. As a general rule, your savings should be sufficient to cover all of your personal expenses, including your mortgage, loan payments, insurance costs, utility bills, food, and clothing expenses for at least three to six months.

Q. How do I calculate compound interest?

Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one. The total initial amount of the loan is then subtracted from the resulting value.

Q. What is the difference between simple interest and compound interest?

Simple Interest vs. Compound Interest: An Overview Simple interest is based on the principal amount of a loan or deposit. In contrast, compound interest is based on the principal amount and the interest that accumulates on it in every period.

Q. How do u calculate interest?

You can calculate Interest on your loans and investments by using the following formula for calculating simple interest: Simple Interest= P x R x T ÷ 100, where P = Principal, R = Rate of Interest and T = Time Period of the Loan/Deposit in years.

Q. How is principal and EMI calculated?

E = P x r x ( 1 + r )n / ( ( 1 + r )n – 1 ) where E is EMI, P is Principal Loan Amount, r is monthly rate of interest (For eg. If rate of interest is 14% per annum, then r = 0.011667), n is loan duration in number of months.

Q. What is the principal of a loan?

Principal is the money that you originally agreed to pay back. Interest is the cost of borrowing the principal. Generally, any payment made on an auto loan will be applied first to any fees that are due (for example, late fees). Then the rest of your payment will be applied to the principal balance of your loan.

Q. What gets paid first principal or interest?

Loan principal is the amount of debt you owe, while interest is what the lender charges you to borrow the money. Interest is usually a percentage of the loan’s principal balance. When you make loan payments, you’re making interest payments first; the the remainder goes toward the principal.

Q. Is it principle or principal on a loan?

(In a loan, the principal is the more substantial part of the money, the interest is—or should be—the lesser.) “Principle” is only a noun, and has to do with law or doctrine: “The workers fought hard for the principle of collective bargaining.”

Q. What happens if I pay principal only?

The principal is the amount you borrowed. The interest is what you pay to borrow that money. But if you designate an additional payment toward the loan as a principal-only payment, that money goes directly toward your principal — assuming the lender accepts principal-only payments.

Q. Is it better to refinance or just pay extra principal?

A rate-lowering refinance reduces the rate of return on future extra payments, which could induce the borrower to reduce or stop such payments. However, the principal motivation for making extra payments seems to be to get out of debt faster, and the refinance won’t change that.

Q. Can you pay off principal before interest?

When you pay extra payments directly on the principal, you are lowering the amount that you are paying interest on. It can help you pay off your debt much more quickly. If you want to pay off your credit card, you will need to make more than the minimum payment each month to reach your goal.

Q. Is it better to put extra money towards escrow or principal?

Many lenders will provide an option on the monthly bill for including extra money toward either your principal balance or the escrow account. By putting extra money in your escrow account, you will not be paying down your principal balance faster. Your lender will only use these funds to bolster your escrow account.

Q. What happens if I pay an extra $1000 a month on my mortgage?

Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. To be more precise, it’d shave nearly 12 and a half years off the loan term. The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat.

Q. Why am I paying more interest than principal car?

Down payment Lenders may charge higher rates when you put little or no money down. This higher rate is in exchange for the risk that you’ll default on the loan and the lender will be left with a vehicle that’s worth less than you owe.

Q. Do extra car payments go to principal?

By the end, almost all of your payment goes toward paying principal. For example, imagine you had a $500 car payment for 60 months at 2.5% interest. If you make extra, principal-only payments, you can shorten the length of the loan while decreasing the total amount of interest you’ll pay over the life of the loan.

Q. Do large principal payments reduce monthly payments?

Putting extra cash towards your mortgage doesn’t change your payment unless you ask the lender to recast your mortgage. Unless you recast your mortgage, the extra principal payment will reduce your interest expense over the life of the loan, but it won’t put extra cash in your pocket every month.

Q. What is the highest interest rate on a car loan by law?

The law says that lenders cannot charge more than 16 percent interest rate on loans. Unfortunately, some lending companies owned by or affiliated with vehicle makers have devised schemes whereby you are charged interest at rates exceeding the maximum permitted by law. This is called usury.

Q. What is the highest legal interest rate?

8% per year

Q. What is a high car interest rate?

Average Auto Loan Rates by Credit Score Consumers with high credit scores, 760 or above, are considered to be prime loan applicants and can be approved for interest rates as low as 3%, while those with lower scores are riskier investments for lenders and generally pay higher interest rates, as high as 20%.