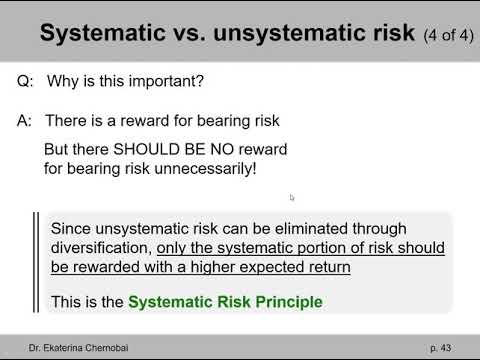

According to this principle, only systemic risks affect the expected return on such a portfolio, because the process of diversification eliminates the risk attached to any particular company, and only the systemic risks endemic to the wider economy may affect the portfolio. …

Q. What are systematic and unsystematic risk?

While systematic risk can be thought of as the probability of a loss that is associated with the entire market or a segment thereof, unsystematic risk refers to the probability of a loss within a specific industry or security.

Table of Contents

- Q. What are systematic and unsystematic risk?

- Q. What is an example of unsystematic risk?

- Q. What is systematic risk and its types?

- Q. Which is the best example of systematic risk?

- Q. Which one of the following is the type of risk that affects a large number of assets?

- Q. What is the difference between systematic and idiosyncratic risk?

- Q. Which of the following is the best definition of unsystematic risk?

- Q. What is another name for unsystematic risk?

- Q. Why is some risk Diversifiable?

- Q. What are the components of unsystematic risk?

- Q. How do you achieve unsystematic risk?

- Q. What are the two components of total risk?

- Q. What is non-Diversifiable risk?

- Q. What is the relationship between Diversifiable and non-Diversifiable risk?

- Q. Is credit risk is a non-Diversifiable risk?

- Q. Which of the following is not a Diversifiable risk?

- Q. Which of the following is Diversifiable risk?

- Q. What are examples of systematic risk?

- Q. Which of the following is systematic risk?

- Q. Which one of the following is an example of systematic risk investors panic causing?

- Q. What do you mean by systematic risk?

- Q. Why is beta a measure of systematic risk What is its meaning?

- Q. What does a beta of 0 mean?

- Q. Is a high beta good or bad?

- Q. What does a beta of 1 mean?

- Q. How do you interpret Beta?

- Q. What does beta mean in apps?

- Q. What does a beta of 1.5 mean?

Q. What is an example of unsystematic risk?

Understanding Unsystematic Risk Examples of unsystematic risk include a new competitor in the marketplace with the potential to take significant market share from the company invested in, a regulatory change (which could drive down company sales), a shift in management, or a product recall.

Q. What is systematic risk and its types?

Systematic risk occurs due to macroeconomic factors. It is also called market risk or non-diversifiable or volatility risk as it is beyond the control of a specific company or individual, and hence, can’t be diversified. All investments and securities suffer from such type of risk.

Q. Which is the best example of systematic risk?

Changes to government policies that affect all sectors are examples of systematic risks. For example, assume that government increases the minimum employee salary by 100%. You know employee cost is a major spend for most of the companies. Hence, such a policy change will affect companies across many sectors.

Q. Which one of the following is the type of risk that affects a large number of assets?

Market risk, or systematic risk, affects a large number of asset classes, whereas specific risk, or unsystematic risk, only affects an industry or particular company.

Q. What is the difference between systematic and idiosyncratic risk?

Idiosyncratic risk refers to inherent risks exclusive to a company. Systematic risk refers to broader trends that could impact the overall market or sector. That’s a fundamental factor that might cause the broader markets to fluctuate. Arguably, every stock or stock index has both idiosyncratic and systematic risk.

Q. Which of the following is the best definition of unsystematic risk?

Question 17 Which of the following is the best definition of unsystematic risk A risk that influences a large number of assets. Also called market risk. A theory showing that the expected return on any risky asset is a linear combination of various factors. Also called unique or asset-specific risks.

Q. What is another name for unsystematic risk?

Meaning of Unsystematic Risk Unsystematic risk is unique to a given business or industry. It is also known as specific risk, nonsystematic risk, residual risk, or diversifiable risk.

Q. Why is some risk Diversifiable?

Some risks are diversifiable because they are unique to that asset and can be eliminated by investing in different assests. Therefore, you are unable to eliminate the total risk of an investment. Lastly, systematic risk can be controlled, but by a costly effect on estimated returns.

Q. What are the components of unsystematic risk?

Components of The Unsystematic Risk However, the unsystematic risk of investment consists of two major components: credit risk and. sector risk.

Q. How do you achieve unsystematic risk?

The market risk is calculated by multiplying beta by standard deviation of the Sensex which equals 4.39% (4.89% x 0.9). The third and final step is to calculate the unsystematic or internal risk by subtracting the market risk from the total risk. It comes out to be 13.58% (17.97% minus 4.39%).

Q. What are the two components of total risk?

-‐ Total risk of a security may be decomposed into two parts: o Unique / Specific Risk – Risk factors affecting only that firm (can be diversified away).

Q. What is non-Diversifiable risk?

Non-diversifiable risk can also be referred as market risk or systematic risk. Putting it simple, risk of an investment asset (real estate, bond, stock/share, etc.) which cannot be mitigated or eliminated by adding that asset to a diversified investment portfolio can be delineated as non-diversifiable risks.

Q. What is the relationship between Diversifiable and non-Diversifiable risk?

Diversifiable risk is the risk of price change due to the unique features of the particular security and it is not dependent on the overall market conditions. Diversifiable risk can be eliminated by diversification in the portfolio. Non-diversifiable risk is the risk common to the entire class of assets or liabilities.

Q. Is credit risk is a non-Diversifiable risk?

Unsystematic risk can be mitigated by diversification and investment in many different companies. Mutual funds are a good investment option to avoid unsystematic risk. Credit Risk: Credit risk (or default risk) the risk that a company will not be able to pay the interest on their corporate bonds.

Q. Which of the following is not a Diversifiable risk?

The risk that the CEO is killed in a plane crash , the risk of a key employee being hired away by a competitor and the risk of a product liability lawsuit are all specific to the company and are all diversifiable risks. The risk that oil prices rise, increasing production costs is non diversificable risk.

Q. Which of the following is Diversifiable risk?

Unsystematic risk (also called diversifiable risk) is risk that is specific to a company. This type of risk could include dramatic events such as a strike, a natural disaster such as a fire, or something as simple as slumping sales. Two common sources of unsystematic risk are business risk and financial risk.

Q. What are examples of systematic risk?

Examples of systematic risks include:

- Macroeconomic factors, such as inflation, interest rates, currency fluctuations.

- Environmental factors, such as climate change, natural disasters, resource, and biodiversity loss.

- Social factors, such as wars, changing consumer perspectives, population trends.

Q. Which of the following is systematic risk?

Systematic risk includes market risk, interest rate risk, purchasing power risk, and exchange rate risk.

Q. Which one of the following is an example of systematic risk investors panic causing?

The correct answer is option of Investors panic causing security prices around the globe to fall precipitously is an example of systematic risk.

Q. What do you mean by systematic risk?

Systemic risk refers to the risk inherent in the whole market or part of the market. Systematic risk is also called the undiversifiable risk, market risk, or volatility. It affects not just a particular stock or industry, but the overall market.

Q. Why is beta a measure of systematic risk What is its meaning?

1. The beta is a relative measure of systematic risk. It indicates the sensitivity of the return on a share with the return on the market. If the market moves by 1% and a share has a beta of two, then the return on the share would move by 2%.

Q. What does a beta of 0 mean?

A zero-beta portfolio is a portfolio constructed to have zero systematic risk, or in other words, a beta of zero. Such a portfolio would have zero correlation with market movements, given that its expected return equals the risk-free rate or a relatively low rate of return compared to higher-beta portfolios.

Q. Is a high beta good or bad?

A high beta means the stock price is more sensitive to news and information, and will move faster than a stock with low beta. In general, high beta means high risk, but also offers the possibility of high returns if the stock turns out to be a good investment.

Q. What does a beta of 1 mean?

A beta of 1 indicates that the security’s price tends to move with the market. A beta greater than 1 indicates that the security’s price tends to be more volatile than the market. A beta of less than 1 means it tends to be less volatile than the market. Many utility sector stocks have a beta of less than 1.

Q. How do you interpret Beta?

A beta that is greater than 1.0 indicates that the security’s price is theoretically more volatile than the market. For example, if a stock’s beta is 1.2, it is assumed to be 20% more volatile than the market. Technology stocks and small cap stocks tend to have higher betas than the market benchmark.

Q. What does beta mean in apps?

Beta apps are newer and more experimental versions of apps that are already released. Early access and beta apps may be less stable than most apps. For example, the app might crash or some features might not work properly.

Q. What does a beta of 1.5 mean?

Roughly speaking, a security with a beta of 1.5, will have move, on average, 1.5 times the market return. [More precisely, that stock’s excess return (over and above a short-term money market rate) is expected to move 1.5 times the market excess return).]