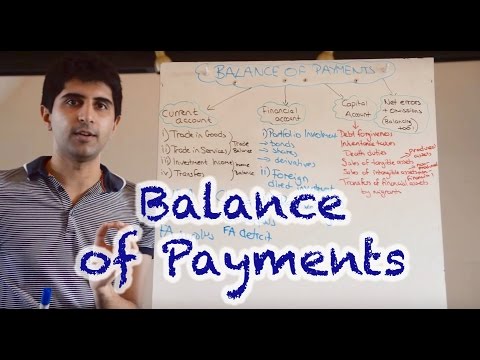

A record of all economic transactions between the residents of the country and the residents of all other countries within a given period of time (1 year). Its role is to show all payments received from other countries (credits) and all payments made to other countries (debits).

Q. What is a unilateral transfer quizlet?

Net unilateral transfers abroad. unilateral transfers received from abroad by US residents minus the unilateral transfers US residents send abroad. Balance on current account.

Table of Contents

- Q. What is a unilateral transfer quizlet?

- Q. What summarizes the transactions that occur during a given time period between residents of that country and residents of other countries quizlet?

- Q. When there is political instability in another country the United States can expect?

- Q. Who first presented the theory of political development?

- Q. How does political instability affect development of a country?

- Q. What are the causes of unpredictability in the economy?

- Q. What are the causes and consequences of instability in the economy quizlet?

- Q. Why does money lose its value in a country with an unstable economy?

- Q. Why does money lose its value during inflation?

- Q. How does exchange rates affect the country’s economy?

- Q. Why is the exchange rate important to the economy?

- Q. What are the impacts of currency devaluation and revaluation on international trade?

- Q. What is the impact of devaluation on foreign investment?

- Q. What is the difference between revaluation and appreciation of a currency?

- Q. What is the difference between devaluation and depreciation?

- Q. What is devaluation in economy?

- Q. How does devaluation affect the economy?

- Q. What does depreciation mean in economics?

- Q. What is the other name of depreciation in economics?

- Q. What is another name for depreciation in economics?

- Q. What is depreciation in economics with example?

- Q. What is depreciation and its types?

- Q. How is depreciation calculated?

Q. What summarizes the transactions that occur during a given time period between residents of that country and residents of other countries quizlet?

is an accounting statement that summarizes (measures) all the economic transactions between residents of the home country and the rest of the world in a specified period of time. The BOP must balance.

Q. When there is political instability in another country the United States can expect?

When political instability exists in another country, the United States can expect? an increase in the capital account balance due to the movement of assets to the U.S.

Q. Who first presented the theory of political development?

Political decay is a political theory, originally described by Samuel P. Huntington, which describes how chaos and disorder can arise from social modernization increasing more rapidly than political and institutional modernization.

Q. How does political instability affect development of a country?

Political instability is likely to shorten policymakers’ horizons leading to sub- optimal short term macroeconomic policies. It may also lead to a more frequent switch of policies, creating volatility and thus, negatively affecting macroeconomic performance.

Q. What are the causes of unpredictability in the economy?

Economic uncertainty could involve. People fear the prospect of being made unemployed. Concerns over prospects for exchange rate – e.g. rapid devaluation of the currency. Concerns over government borrowing – e.g. markets unwilling to finance more debt, leading to default.

Q. What are the causes and consequences of instability in the economy quizlet?

Causes of economic instability are as follow: 1- Inflation and hyperinflation. Consequences of economic instability are as follow: 1- High unemployment rates. 2- Decreased GDP.

Q. Why does money lose its value in a country with an unstable economy?

Money loses value when its purchasing power falls. Since inflation is a rise in the level of prices, the amount of goods and services a given amount of money can buy falls with inflation. Just as inflation reduces the value of money, it reduces the value of future claims on money.

Q. Why does money lose its value during inflation?

Inflation increases the price of goods and services over time, effectively decreasing the number of goods and services you can buy with a dollar in the future as opposed to a dollar today. This effectively decreases the time value of money, since it will cost twice as much to purchase the same product in the future.

Q. How does exchange rates affect the country’s economy?

Aside from factors such as interest rates and inflation, the currency exchange rate is one of the most important determinants of a country’s relative level of economic health. A higher-valued currency makes a country’s imports less expensive and its exports more expensive in foreign markets.

Q. Why is the exchange rate important to the economy?

The exchange rate is important for several reasons: a. It serves as the basic link between the local and the overseas market for various goods, services and financial assets. Using the exchange rate, we are able to compare prices of goods, services, and assets quoted in different currencies.

Q. What are the impacts of currency devaluation and revaluation on international trade?

There are two implications of a devaluation. First, devaluation makes the country’s exports relatively less expensive for foreigners. Second, the devaluation makes foreign products relatively more expensive for domestic consumers, thus discouraging imports.

Q. What is the impact of devaluation on foreign investment?

First, a devaluation reduces the return to foreign investment for the source country in terms of its own currency. This would reduce the supply of f 1. Second, an increase in the domestic prices in the host country in terms of its own currency increases the demand for capital and thus the rate of returns to capital.

Q. What is the difference between revaluation and appreciation of a currency?

Revaluation means a rise of domestic currency in relation to foreign currency in a fixed exchange rate whereas appreciation implies an increase in the external value of a currency.

Q. What is the difference between devaluation and depreciation?

A devaluation occurs when a country makes a conscious decision to lower its exchange rate in a fixed or semi-fixed exchange rate. A depreciation is when there is a fall in the value of a currency in a floating exchange rate.

Q. What is devaluation in economy?

Devaluation is the deliberate downward adjustment of the value of a country’s money relative to another currency, group of currencies, or currency standard. It is often confused with depreciation and is the opposite of revaluation, which refers to the readjustment of a currency’s exchange rate.

Q. How does devaluation affect the economy?

A devaluation means there is a fall in the value of a currency. The main effects are: Exports are cheaper to foreign customers. In the short-term, a devaluation tends to cause inflation, higher growth and increased demand for exports.

Q. What does depreciation mean in economics?

Economic depreciation is a measure of the decrease in the market value of an asset over time from influential economic factors. In accounting depreciation, an asset is expensed over a specific amount of time, based on a set schedule.

Q. What is the other name of depreciation in economics?

Depreciation = Consumption of fixed capital / Depreciation allowance / Replacement of cost of fixed capital / Current Replacement..

Q. What is another name for depreciation in economics?

In this page you can discover 28 synonyms, antonyms, idiomatic expressions, and related words for depreciation, like: devaluation, deprecation, minimization, denigration, derogation, detraction, disparagement, increase, attack, show and wear-and-tear.

Q. What is depreciation in economics with example?

In accounting terms, depreciation is defined as the reduction of recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery etc..

Q. What is depreciation and its types?

Depreciation is the accounting process of converting the original costs of fixed assets such as plant and machinery, equipment, etc into the expense. It refers to the decline in the value of fixed assets due to their usage, passage of time or obsolescence. One such factor is the depreciation method.

Q. How is depreciation calculated?

Straight-line depreciation How it works: You divide the cost of an asset, minus its salvage value, over its useful life. That determines how much depreciation you deduct each year.