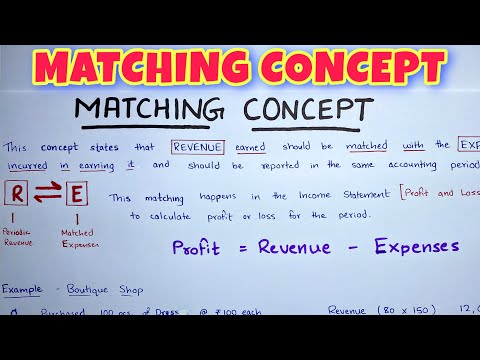

What Is the Matching Concept in Accounting? An important concept of accrual accounting, the matching principle states that the related revenues and expenses must be matched in the same period. This is done in order to link the costs of an asset or revenue to its benefits.

Q. What is dual effect?

The dual effect principle is the foundation or basic principle of accounting. It provides the very basis for recording business transactions into the records of a business. This concept states that every transaction has a dual or double effect and should therefore be recorded in two places.

Table of Contents

- Q. What is dual effect?

- Q. What is dual aspect concept with example?

- Q. What is objectivity concept?

- Q. What is matching concept Why should?

- Q. What is full disclosure concept?

- Q. What is the concept of disclosure?

- Q. What is concept of conservatism?

- Q. What is adequate disclosure principle?

- Q. What is a going concern principle?

- Q. What is the full disclosure principle provide examples?

- Q. What is monetary principle?

- Q. What is purpose of disclosure?

- Q. What is consistency concept?

- Q. What are the 5 major types of accounting?

Q. What is dual aspect concept with example?

Dual aspect is the foundation or basic principle of accounting. It means, both the aspects of the transaction must be recorded in the books of accounts. For example, goods purchased for cash has two aspects which are (i) Giving of cash (ii) Receiving of goods. These two aspects are to be recorded.

Q. What is objectivity concept?

The objectivity principle is the concept that the financial statements of an organization be based on solid evidence. The intent behind this principle is to keep the management and the accounting department of an entity from producing financial statements that are slanted by their opinions and biases.

Q. What is matching concept Why should?

Give reason why a a business concern should follow this concept. Matching concept states that expenses that are incurred in an accounting period should be matching with the revenue earned during that period. As revenue and expenses are matched, the profit or loss is not over or under-stated.

Q. What is full disclosure concept?

The full disclosure principle is a concept that requires a business to report all necessary information about their financial statements and other relevant information to any persons who are accustomed to reading this information.

Q. What is the concept of disclosure?

Disclosure is the process of making facts or information known to the public. Proper disclosure by corporations is the act of making its customers, investors, and any people involved in doing business with the company aware of pertinent information.

Q. What is concept of conservatism?

The conservatism principle is the general concept of recognizing expenses and liabilities as soon as possible when there is uncertainty about the outcome, but to only recognize revenues and assets when they are assured of being received. The conservatism principle can also be applied to recognizing estimates.

Q. What is adequate disclosure principle?

Adequate disclosure is the concept that the complete package of an entity’s financial statements and accompanying disclosures should provide all key information needed by users to understand the entity’s financial situation.

Q. What is a going concern principle?

What Is Going Concern? Going concern is an accounting term for a company that has the resources needed to continue operating indefinitely until it provides evidence to the contrary. This term also refers to a company’s ability to make enough money to stay afloat or to avoid bankruptcy.

Q. What is the full disclosure principle provide examples?

The Full Disclosure Principle states that all relevant and necessary information for the understanding of a company’s financial statements must be included in public company filings. For example, financial analysts who read financial statements need to know what inventory valuation.

Q. What is monetary principle?

The monetary unit principle states that business transactions should only be recorded if they can be expressed in terms of a currency. According to the monetary unit principle, when business transactions or events occur, they are first converted into money, and then recorded in the financial accounts of a business.

Q. What is purpose of disclosure?

The purpose of disclosure is to make available evidence which either supports or undermines the respective parties’ cases.

Q. What is consistency concept?

The concept of consistency means that accounting methods once adopted must be applied consistently in future. If for any valid reasons the accounting policy is changed, a business must disclose the nature of change, the reasons for the change and its effects on the items of financial statements.

Q. What are the 5 major types of accounting?

The chart of accounts organizes your finances into five major categories, called accounts: assets, liabilities, equity, revenue and expenses. These topics will help you better understand what a chart of accounts is and how its used by small businesses: What Is a Chart of Accounts Used For?