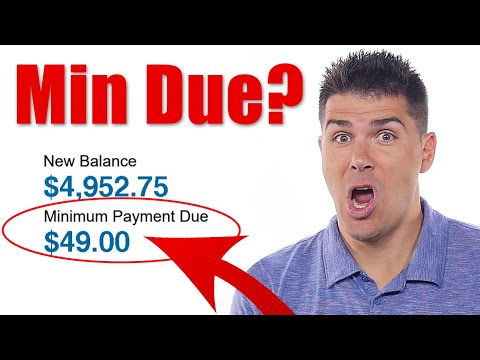

The minimum monthly payment is the lowest amount a customer can pay on their revolving credit account per month to remain in good standing with the credit card company. The amount of the minimum monthly payment is calculated as a small percentage of the consumer’s total credit balance.

Q. What happens when you pay the minimum on a credit card?

If you pay the credit card minimum payment, you won’t have to pay a late fee. But you’ll still have to pay interest on the balance you didn’t pay. Sherry says, “You’ll pay more interest the longer you make minimum payments because your balance is still subject to finance charges until it’s paid off.”

Table of Contents

- Q. What happens when you pay the minimum on a credit card?

- Q. Does only making the minimum payment hurt your credit score?

- Q. Should you stick with the minimum payments on your credit card?

- Q. Does credit limit increase automatically?

- Q. How can I raise my credit limit without asking?

- Q. How can I raise my credit limit without hard inquiry?

- Q. What credit cards give the highest limits?

- Q. What is the average limit on a credit card?

- Q. What is the golden rule of credit cards?

- Q. What is considered a good age of credit?

- Q. Should I pay off my credit card all at once?

Q. Does only making the minimum payment hurt your credit score?

No, paying the minimum on a credit card does not hurt your credit score – at least not directly. And as long as you pay the minimum amount required by your card issuer, the exact amount you pay doesn’t factor into the payment history portion of your credit score. It’s simply noted that you’ve made a payment on time.

Q. Should you stick with the minimum payments on your credit card?

While you can choose to simply make the minimum repayment on your personal credit card each month, doing so can come at a cost. If you only pay the minimum, you’ll end up paying more interest and it may take longer to pay off or reduce your credit card balance.

Q. Does credit limit increase automatically?

Automatic Credit Limit Increase Some credit card issuers automatically raise your credit limit as you handle credit responsibly. Many credit card issuers review accounts periodically and automatically raise the credit limit for cardholders who meet their criteria.

Q. How can I raise my credit limit without asking?

How to get a credit limit increase without asking:

- Always pay all your bills on time.

- Pay off the card you want the higher limit on fully each month.

- Update your income on the credit card company’s website/app.

- Keep your account open for at least 6-12 months.

Q. How can I raise my credit limit without hard inquiry?

3 Ways to Get a Credit Card Limit Increase without Asking

- Update Your Income. Your income isn’t the only factor card issuers may consider when they review your account for an auto-CLI, but it may be one of the more important.

- Use Your Card Responsibly. Card issuers generally like customers who:

- Wait.

Q. What credit cards give the highest limits?

Best High Limit Credit Cards of June 2021

| Card Name | Best For: | Credit Limit |

|---|---|---|

| Chase Sapphire Reserve® | Highest Limit | Credit limit from $10,000 |

| Chase Sapphire Preferred® Card | Overall | Credit limit from $5,000 |

| Wells Fargo Platinum card | Balance Transfers | Credit limit from $1,000 |

| Chase Freedom Unlimited® | 0% Purchases | Credit limit from $500 |

Q. What is the average limit on a credit card?

$22,751

Q. What is the golden rule of credit cards?

Remember the golden rule: credit isn’t cash! Use your cards responsibly, and only spend what you can afford to pay off by the next due date. If you cannot, simply delay your purchases or start saving for them in advance.

Q. What is considered a good age of credit?

What is a good credit history length? Seven years is deemed a reasonable amount of time to establish a good credit history. After seven years, most negative items will fall off your credit report. However, the seven-year time period doesn’t guarantee your credit score and credit history will improve.

Q. Should I pay off my credit card all at once?

Paying off your credit card all at once can raise your credit score by reducing your credit utilization. However, if you’ve received a financial windfall, consider saving a big portion of it instead of paying off a big balance. Filed Under: Credit Scores and Reports.