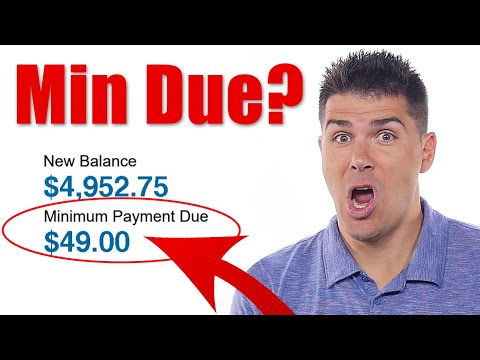

What Happens If I Make Only the Minimum Payment on My Credit Card? Making only the minimum payment on your credit card keeps your account in good standing and avoids late fees, but that’s about all it does. It won’t get you very far toward reducing your credit card debt.

Q. Why is it a better idea to pay more than the minimum payment each month?

But paying more than the minimum on your credit card bills helps you chip away at your overall balance, which improves your credit utilization and raises your score. Also, if you’re still using your cards for new purchases, paying more than the minimum is important because you’re not letting the debt pile up.

Table of Contents

- Q. Why is it a better idea to pay more than the minimum payment each month?

- Q. Why is it important to pay at least the monthly minimum payment on every debt?

- Q. Does your credit score go down if you pay minimum?

- Q. What is the best way to pay off a debt?

- Q. What should I pay off to increase my credit score?

Q. Why is it important to pay at least the monthly minimum payment on every debt?

It’s important to at least pay the minimum each month to avoid late fees, penalty APRs and to preserve your credit rating. If possible, you want to pay the balance in full every month to keep your utilization low and save a bundle on interest and possibly help lift your credit score.

Q. Does your credit score go down if you pay minimum?

By itself, a minimum payment won’t hurt your credit score, because you’re not missing a payment. Nonetheless, experts strongly suggest making more than the minimum payment each month to avoid digging yourself into a financial hole.

Q. What is the best way to pay off a debt?

Here are 12 easy ways to pay off debt:

- Create a budget.

- Pay off the most expensive debt first.

- Pay more than the minimum balance.

- Take advantage of balance transfers.

- Halt your credit card spending.

- Use a debt repayment app.

- Delete credit card information from online stores.

- Sell unwanted gifts and household items.

Q. What should I pay off to increase my credit score?

Paying down the card with the highest utilization ratio could help your credit scores, as the individual account utilization is considered by credit scoring models. Paying down the card with the lowest balance could help you decrease how many of your accounts have a balance, which may also improve your credit scores.