Where does the money go? Unused FSA money returns to your employer. The funds can be used towards offsetting administrative costs incurred during the plan year, employers can also reduce annual premiums in the next FSA year, or funds must be equally distributed to employees who enroll in an FSA for the next year.

Q. Can you use FSA to pay for previous years expenses?

Can I use my Health Care FSA to reimburse outstanding medical expenses from the prior year? No, expenses must be incurred during the current plan year. The only exception to this rule is orthodontics.

Table of Contents

- Q. Can you use FSA to pay for previous years expenses?

- Q. What expenses are eligible for FSA reimbursement?

- Q. Are all employees eligible for FSA?

- Q. Are FSA limits based on calendar year?

- Q. Can I use my 2020 FSA for 2021 expenses?

- Q. What items are FSA eligible 2021?

- Q. Is toilet paper FSA eligible?

- Q. What items are eligible for FSA?

- Q. Who is not eligible for FSA?

- Q. What is the maximum FSA limit for 2021?

- Q. Can I use my 2021 FSA for 2020 expenses?

- Q. What do FSA accounts do for federal employees?

- Q. How much money can you put in a FSA per year?

- Q. What’s the maximum contribution to a Dependent Care FSA?

- Q. What can I use my health care FSA for?

Q. What expenses are eligible for FSA reimbursement?

The IRS determines which expenses are eligible for reimbursement. Eligible expenses include health plan co-payments, dental work and orthodontia, eyeglasses and contact lenses, and prescriptions. This type of FSA is offered by most employers. It covers medical, dental, vision, and pharmacy expenses.

Q. Are all employees eligible for FSA?

Only employees of eligible employers can be enrolled in an FSA. (If you are self-employed, check out a Medical Savings Account (MSA) instead.) You may be eligible for one or more FSAs, which probably have different amounts that you can contribute.

Q. Are FSA limits based on calendar year?

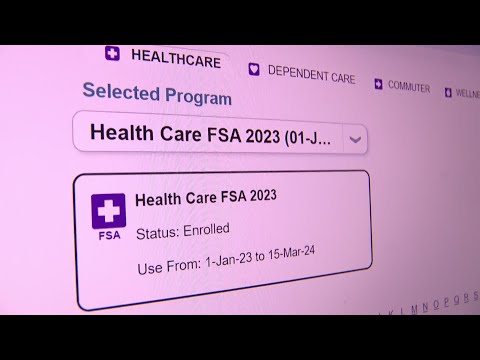

A Flexible Spending Account plan year does not have to be based on the calendar year. The FSA plan Administrator or employer decides when the FSA plan year begins, and often aligns the FSA to match their health plan or fiscal year. There is an “open enrollment” period once a year.

Q. Can I use my 2020 FSA for 2021 expenses?

Regardless of which type of FSA you have, legislation signed into law late last year allows you to roll over any unused funds from 2021 to 2022 for use at any time next year, if your company opts in. This also applied to unused 2020 FSA money, which could be carried over into 2021.

Q. What items are FSA eligible 2021?

Here’s a list of Health FSA-eligible items you can buy without a prescription:

- Acne light therapy.

- Athletic and orthopedic braces and supports.

- Breast pumps and accessories.

- Blood glucose monitors and testing strips.

- Blood pressure monitors.

- Condoms.

- Contact lenses and supplies.

- Denture cream and cleansers.

Q. Is toilet paper FSA eligible?

Toiletries can describe anything from oral care items like mouthwash, toothbrushes, toothpaste and floss to hair products like shampoo and conditioners; bathroom products like toilet paper; feminine care like tampons and pads; cotton swabs and fingernail clippers, and more.

Q. What items are eligible for FSA?

Q. Who is not eligible for FSA?

Though there are exceptions, self-employed employees and shareholders who own 2% or more in an S-Corp, LLC, LLP, PC, sole proprietorship, or partnerships are generally ineligible for FSAs. Employees with HSAs should not enroll in an FSA.

Q. What is the maximum FSA limit for 2021?

$2,750

Health Care FSA Maximum Plan Limit The pre-tax salary reduction limit for Health Care FSAs will remain at $2,750 for plan years on or after January 1, 2021. The Health Care FSA pre-tax salary reduction limit is per employee, per employer, per plan year.

Q. Can I use my 2021 FSA for 2020 expenses?

Q. What do FSA accounts do for federal employees?

FSAFEDS allows you to save money for health care expenses with a Health Care or Limited Expense Health Care FSA. Think of it as a savings account that helps you pay for items that typically aren’t covered by your FEHB Plan, the Federal Employees Dental and Vision Insurance Program, or other health insurance coverage.

Q. How much money can you put in a FSA per year?

A few fast facts about FSAs FSAs are limited to $2,750 per year per employer. If you’re married, your spouse can put up to $2,750 in an FSA with their employer too. You can use funds in your FSA to pay for certain medical and dental expenses for you, your spouse if you’re married, and your dependents.

Q. What’s the maximum contribution to a Dependent Care FSA?

However as a result of Health Care Reform beginning January 1, 2013 the maximum contribution amount for the health care FSA will be $2,500. For dependent care FSAs, the annual maximum you can contribute is $5,000, including any amount set aside by a spouse into their dependent care FSA.

Q. What can I use my health care FSA for?

A Your health care FSA can be used to pay for a variety of health care expenses incurred by you, your spouse and your dependents. Doctor visits, chiropractor fees, prescription drug copayments, dental care and vision care not otherwise covered by a health plan are all eligible health care expenses.