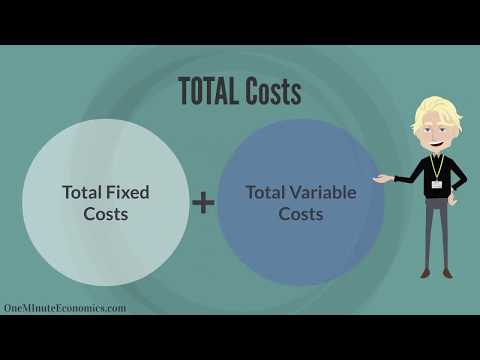

Transport costs are the costs internally assumed by the providers of transport services. They come as fixed (infrastructure) and variable (operating) costs, depending on various conditions related to geography, infrastructure, administrative barriers, energy, and how passengers and freight are carried.

Q. What are the basis of transportation rates?

The main factors in determining the freight rate are: mode of transportation, weight, size, distance, points of pickup and delivery, and the actual goods being shipped.

Table of Contents

- Q. What are the basis of transportation rates?

- Q. What is transportation pricing?

- Q. How is total transportation cost calculated?

- Q. Is a cell phone a fixed or variable expense?

- Q. What is the difference between a fixed and variable income?

- Q. What are examples of fixed income?

- Q. Is fixed income a good investment?

- Q. What are the two main types of fixed income investments?

- Q. Why is fixed income Bad?

- Q. How can you avoid income risk?

- Q. What is the difference between a stock’s price and its value?

- Q. How can I protect my money today?

Q. What is transportation pricing?

They are costs imposed on society as a whole through an individual making a trip or a transport operator providing a service. These costs are not paid for by the user – social costs are incurred as a result of external effects of the transport activity.

Q. How is total transportation cost calculated?

To calculate your transportation expense ratio:

- Start with your average monthly (or yearly) transportation expenses.

- Divide this figure by your gross monthly (or yearly) income, before taxes and any other adjustments.

Q. Is a cell phone a fixed or variable expense?

Fixed expenses are consistent and expected bills you pay each month, such as a mortgage or rent, a cellphone bill and a student loan payment. Car insurance, home insurance and life insurance are also fixed payments, along with your monthly electric and water bills.

Q. What is the difference between a fixed and variable income?

The most common example of variable income investments are stocks, or shares. On the other hand, fixed income refers to investments that pay fixed interest until the maturity date and, at maturity, investors are paid the amount that they previously invested.

Q. What are examples of fixed income?

Treasury bonds and bills, municipal bonds, corporate bonds, and certificates of deposit (CDs) are all examples of fixed-income products. Bonds trade over-the-counter (OTC) on the bond market and secondary market.

Q. Is fixed income a good investment?

Because fixed income typically carries less risk, these assets can be a good choice for investors who have less time to recoup losses. However, you should be mindful of inflation risk, which can cause your investments to lose value over time. Fixed income investments can help you generate a steady source of income.

Q. What are the two main types of fixed income investments?

Seven types of fixed-income investments:

- Bond ETFs and mutual funds.

- Short-term bonds.

- Preferred stock.

- High-yield bond funds.

- Municipal bonds.

- Corporate bonds.

- Government bonds.

Q. Why is fixed income Bad?

Inflation Risk That, along with the fixed nature of their interest payments, makes them particularly vulnerable when inflation hits. If that happens, then your investment income is not keeping up with inflation. In fact, you’d be losing money because the value of the cash you invested in the bond is declining.

Q. How can you avoid income risk?

Minimizing Income Risk One strategy for minimizing the degree of income risk associated with a portfolio is to diversify the assets so that long-term investments with fixed rates of interest are balanced with short-term income fund holdings.

Q. What is the difference between a stock’s price and its value?

There is a big difference between the two. The stock’s price only tells you a company’s current value or its market value. So, the price represents how much the stock trades at—or the price agreed upon by a buyer and a seller. On the other hand, the intrinsic value is a company’s actual worth in dollars.

Q. How can I protect my money today?

How to Minimize Risk and Protect Your Money During Times of…

- Reduce and eliminate debt. Debt in the form of credit cards, personal and business loans, and medical debt can represent a significant amount of your monthly budget.

- Consolidate your debt.

- Find passive income or start a side hustle.

- Have a savings fund.

- Diversify your investments.

- Be prepared.