You Pay off Your Credit Card Balances Faster When you only make the minimum payment, it can take a long time to pay off your balance completely. If you pay $460.54 each month towards that same card, you’ll pay off the entire balance in a year and pay only $529.69 in interest, saving yourself $880.54.

Q. What happens when you make the minimum monthly payments on your credit card?

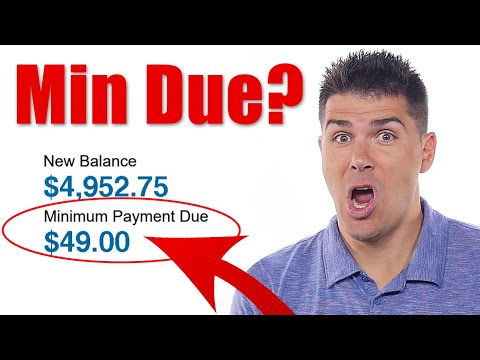

Paying only the minimum amount due on your credit card bill could impact your credit scores and cause you to pay a lot in interest. On the other hand, paying more than the minimum helps you save money, pay off your credit card balances faster and possibly improve your credit scores.

Table of Contents

- Q. What happens when you make the minimum monthly payments on your credit card?

- Q. Why should you never pay the minimum payment?

- Q. Why is paying the monthly minimum amount to the credit card company a bad idea?

- Q. What happens if I pay only the minimum amount due?

- Q. Do you get charged interest if you pay minimum payment?

- Q. How many times can I pay my credit card a month?

- Q. Does paying minimum balance hurt credit?

- Q. Is it better to pay minimum payments or in full?

- Q. How do credit card companies make money if you pay full?

Q. Why should you never pay the minimum payment?

Offering only the minimum payment keeps you in debt longer and racks up interest charges. It can also put your credit score at risk. Making only the minimum payment on your credit card keeps your account in good standing and avoids late fees, but that’s about all it does.

Q. Why is paying the monthly minimum amount to the credit card company a bad idea?

Because it takes so long to pay off your balance when you’re paying the minimum on your credit card, interest builds up longer. Credit card companies set the minimum low to maximize the interest they earn on your account. When you make only the minimum payment, you ultimately pay more than you owed originally.

Q. What happens if I pay only the minimum amount due?

Risk of paying the minimum amount The interest is charged from the date of the purchase, and not the end of the billing cycle. Hence, every time you pay only the minimum balance you incur interest charge on that amount from day one and effectively lose out on the benefit of the credit-free period.

Q. Do you get charged interest if you pay minimum payment?

If you pay the credit card minimum payment, you won’t have to pay a late fee. But you’ll still have to pay interest on the balance you didn’t pay. Sherry says, “You’ll pay more interest the longer you make minimum payments because your balance is still subject to finance charges until it’s paid off.”

Q. How many times can I pay my credit card a month?

It’s actually possible to pay off your credit card bill too many times per month. Once is enough. In fact, once, most of the time, is ideal.

Q. Does paying minimum balance hurt credit?

No, paying the minimum on a credit card does not hurt your credit score – at least not directly. And as long as you pay the minimum amount required by your card issuer, the exact amount you pay doesn’t factor into the payment history portion of your credit score.

Q. Is it better to pay minimum payments or in full?

When it comes to paying off your credit card balances, you have multiple options. It can be tempting to only pay the minimum. Paying the balance in full, however, is best when you’re able. It may help prevent your credit score from lowering and can save you money long-term.

Q. How do credit card companies make money if you pay full?

Interest. The majority of revenue for mass-market credit card issuers comes from interest payments, according to the Consumer Financial Protection Bureau. However, interest is avoidable. Issuers typically charge interest only when you carry a balance from month to month.