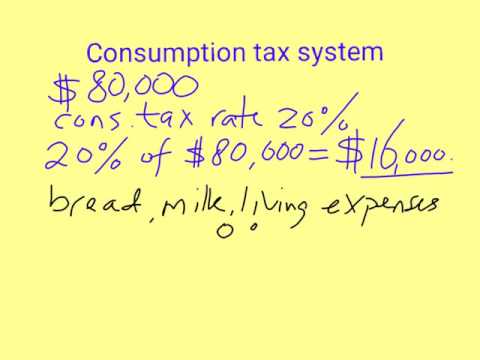

A consumption tax essentially taxes people when they spend money. And the income tax you’re fundamentally taxed when you earn money or when you get interest, dividends, capital gains, and so on. And a consumption tax that wouldn’t happen, you would be taxed essentially when you actually spent the money at the store.

Q. What is consumption based tax?

A consumption tax is a tax on the purchase of a good or service. A consumption tax can also refer to a taxing system as a whole in which people are taxed based on how much they consume rather than how much they add to the economy (income tax).

Table of Contents

- Q. What is consumption based tax?

- Q. How does the government use tax incentives?

- Q. How does tax affect consumption?

- Q. What are the pros and cons of consumption tax?

- Q. What happened to equilibrium output level if the tax increases?

- Q. What is the consequence of increased government spending after a negative supply shock?

- Q. What causes positive supply shock?

- Q. How do you fix a positive supply shock?

- Q. How does an increase in government spending affect a business?

- Q. Does government spending increase interest rates?

- Q. Is LM model government spending increase?

Q. How does the government use tax incentives?

States and the federal government use tax incentives to encourage investment in these zones – i.e., starting businesses or moving operations into them, investing in already-existing businesses, training local people to start their own businesses, etc.

Q. How does tax affect consumption?

Taxation reduces the purchasing power of the people and it reduces their consumption. The decline in consumption leads to decrease in effective demand for the goods and services, which in turn affects the production of these commodities.

Q. What are the pros and cons of consumption tax?

“Under a consumption tax only the money you spend on ‘stuff’ is taxed; all the money you save is tax free until you spend it in the future.” And savings can lead to more economic growth over the long term. The downside of higher consumption taxes, he says, is the impact it has on low-income families.

Q. What happened to equilibrium output level if the tax increases?

When taxes increase: Consumption goes down, leading to a decrease in output/income. The decrease in income reduces the demand for money. Given that the supply of money is fixed, the interest rate must decrease to push up the demand for money and maintain the equilibrium.

Q. What is the consequence of increased government spending after a negative supply shock?

In effect, in this model an increase in government spending generates a negative wealth effect that causes an increase in labor supply, a decline in real wages, and a contraction in household spending.

Q. What causes positive supply shock?

A positive supply shock may be created by a new manufacturing technique, such as when the assembly line was introduced to car manufacturing by Henry Ford. 1 They can also result from a technological advancement or the discovery of new resource input.

Q. How do you fix a positive supply shock?

Policies to deal with economic shocks include

- Monetary policy – to reduce inflation or boost economic growth.

- Fiscal policy – higher government borrowing to finance higher government spending.

- Devaluation – reduce the value of the currency to boost exports.

- Supply-side policies.

Q. How does an increase in government spending affect a business?

How does government spending affect businesses? For firms selling goods and services to individual consumers and to other firms: Increased government spending may mean higher taxes. Higher taxes reduce the ability of customers to purchase goods and services, which is likely to reduce consumer spending.

Q. Does government spending increase interest rates?

If a budget deficit is the result of higher government spending, the additional government spending expands aggregate spending directly. It will increase short-term real interest rates directly, and this will reduce interest-sensitive spending (i.e., private investment and consumer durables).

Q. Is LM model government spending increase?

Fiscal policy has no direct effect on the LM curve. Increased government spending or a tax cut is assumed to be financed by borrowing. The money supply does not change, so the LM curve does not change.