To calculate your commission for a specific period, multiply the appropriate commission rate by the base for that period. For example, if you made $30,000 worth of sales from January 1 to January 15 and your commission rate is 5%, multiply 30,000 by . 05 to find your commission payment amount of $1,500.

Q. How do you account for sales commissions?

Write “Sales commissions expense” and the amount of the expense as a line item in the operating expenses section of your income statement at the end of the accounting period. In this example, write “Sales commissions expense $100,000” on your income statement at the end of the year.

Table of Contents

- Q. How do you account for sales commissions?

- Q. What account does sales commission in accounting?

- Q. What are sales commissions classified as?

- Q. What type of account is commissions?

- Q. How do you record commission in accounting?

- Q. Is sales commission a revenue or expense?

- Q. What is commission in accounting?

- Q. What is commission in accounts?

- Q. What is the commission formula?

- Q. How do you calculate sales commission in Excel?

- Q. What is the formula for commission?

- Q. Where are sales commissions recorded in an account?

- Q. What is the accounting for commissions in business?

- Q. When do you record a commission on a cash basis?

- Q. Where does Commission expense go in the cost of goods sold?

Q. What account does sales commission in accounting?

selling expense

Sales commissions are a key component of a company’s selling expense, and so are normally reported within the operating expenses portion of the income statement. Usually, they are listed within the selling, general, and administrative expenses section of the income statement.

Q. What are sales commissions classified as?

Sales commissions paid out are classified as a selling expense, and so are reported on the income statement within the operating expenses section. This means that commissions are situated after the cost of goods sold.

Q. What type of account is commissions?

Commissions are compensation for obtaining sales. Hence, sales commissions are a selling expense and will be recorded in general ledger accounts having Sales Commissions Expenses in their title. Sales commissions are considered to be operating expenses and are presented on the income statement as SG&A expenses.

Q. How do you record commission in accounting?

Under the cash basis of accounting, you should record a commission when it is paid, so there is a credit to the cash account and a debit to the commission expense account. You can classify the commission expense as part of the cost of goods sold, since it directly relates to the sale of goods or services.

Q. Is sales commission a revenue or expense?

Most sales commissions are a selling expense, and so should be reported on the income statement as part of operating expenses. Often, they will appear under the selling, general, and administrative expenses (SG&A) category.

Q. What is commission in accounting?

Commission Accounting can easily be defined as a revenue or expense to the company during the process of a sale. Typically, there is a percentage amount that a company or person receives upon the receipt of a sale.

Q. What is commission in accounts?

Q. What is the commission formula?

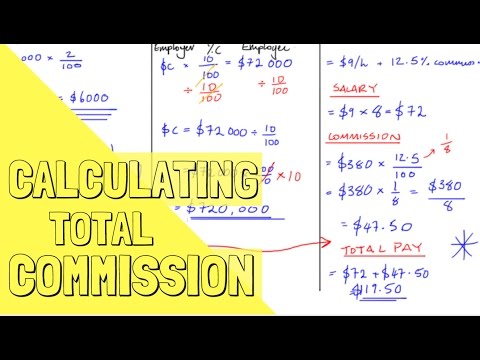

How to calculate commission. This is a very basic calculation revolving around percents. Just take sale price, multiply it by the commission percentage, divide it by 100.

Q. How do you calculate sales commission in Excel?

You multiply the sales by the base rate in B1. As you copy the formula to other months and rows, it always needs to point to B1. Thus, you need to use dollar signs before the B and before the 1: $B$1. To incorporate the product bonus, you need to multiply sales by the product rate in column C.

Q. What is the formula for commission?

An example calculation: a blue widget is sold for $70 . The sales person works on a commission – he/she gets 14% out of every transaction, which amounts to $9.80 . So the formula is: commission_amount = sale price * commission_percentage / 100 . So now you know how to calculate commission.

Q. Where are sales commissions recorded in an account?

Commissions are compensation for obtaining sales. Hence, sales commissions are a selling expense and will be recorded in general ledger accounts having Sales Commissions Expenses in their title.

Q. What is the accounting for commissions in business?

What is the Accounting for Commissions? A commission is a fee that a business pays to a salesperson in exchange for his or her services in either facilitating, supervising, or completing a sale. The commission may be based on a flat fee arrangement, or (more commonly) as a percentage of the revenue generated.

Q. When do you record a commission on a cash basis?

Under the cash basis of accounting, you should record a commission when you pay it, so there is a credit to the cash account and a debit to the commission expense account. You can classify the commission expense as part of the cost of goods sold, since it directly relates to the sale of goods or services.

Q. Where does Commission expense go in the cost of goods sold?

Commission expense accounting. You can classify the commission expense as part of the cost of goods sold, since it directly relates to the sale of goods or services. It is also acceptable to classify it as part of the expenses of the sales department.