In finance, accretion is also the accumulation of additional income an investor expects to receive after purchasing a bond at a discount and holding until maturity. The accretion rate is determined by dividing a bond’s discount by the number of years in its term to maturity.

Q. What was the first line of the solar system?

The order of the planets in the solar system, starting nearest the sun and working outward is the following: Mercury, Venus, Earth, Mars, Jupiter, Saturn, Uranus, Neptune and then the possible Planet Nine. If you insist on including Pluto, it would come after Neptune on the list.

Table of Contents

- Q. What was the first line of the solar system?

- Q. What is the accretion process?

- Q. What makes a transaction accretive?

- Q. What causes accretion?

- Q. How do you record accretion expenses?

- Q. Is land an accretion expense?

- Q. What is the difference between accretion and amortization?

- Q. Is Aro an asset?

- Q. How is the sale of an asset recorded?

- Q. What is decommissioning of assets?

- Q. What is asset retirement SAP?

- Q. How does SAP calculate asset retirement?

- Q. How do I retire an asset in SAP?

- Q. How do you retire multiple assets in SAP?

- Q. What is Fixed asset retirement?

- Q. How do you sell an asset without customer in SAP?

- Q. How do you post F 92 in SAP?

- Q. How do you find the net book value of assets in SAP?

- Q. How do you post asset sale with customer in SAP?

- Q. How do you post an asset in SAP?

- Q. How do you post an asset entry in SAP?

- Q. How do you sell a fixed asset in SAP?

- Q. What are 3 types of assets?

Q. What is the accretion process?

In planetary science, accretion is the process in which solids agglomerate to form larger and larger objects and eventually planets are produced. The initial conditions are a disc of gas and microscopic solid particles, with a total mass of about 1% of the gas mass. Accretion has to be effective and fast.

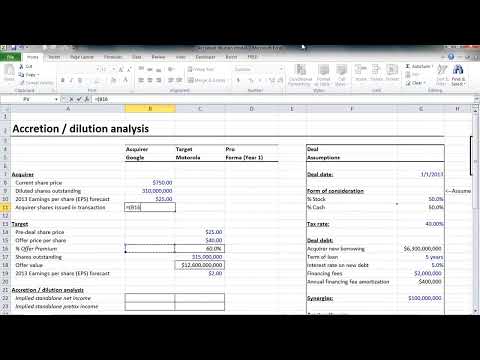

Q. What makes a transaction accretive?

A merger and acquisition (M&A) deal is said to be accretive if the acquiring firm’s earnings per share (EPS) increase after the deal goes through. If the resulting deal causes the acquiring firm’s EPS to decline, the deal is considered to be dilutive.

Q. What causes accretion?

The accretion disk forms when diffuse material is attracted to a massive central body, like a black hole. The flattened shape of the accretion disk is due to angular momentum, which dictates the particles’ motion as they rotate around the black hole.

Q. How do you record accretion expenses?

Generally, accretion is recognized as an operating expense in the statement of income and often associated with an asset retirement obligation. The journal entry to record this cost would be a debit to accretion expense, offset by a credit to the ARO liability. (You’ll see this entry outlined in our example below).

Q. Is land an accretion expense?

Businesses often use this type of accounting for the development of assets in the form of an accretion expense, or an increase in the present value as the asset draws closer to its final future value. Accretion real estate is simply the development of land through the growth and development of land. …

Q. What is the difference between accretion and amortization?

The adjustment type “Amortization” decreases cost and decreases income; the adjustment type “Accretion” increases cost and increases income.

Q. Is Aro an asset?

In accounting, an asset retirement obligation (ARO) describes a legal obligation associated with the retirement of a tangible, long-lived asset, where a company will be responsible for removing equipment or cleaning up hazardous materials at some future date. …

Q. How is the sale of an asset recorded?

Loss on sale. Debit cash for the amount received, debit all accumulated depreciation, debit the loss on sale of asset account, and credit the fixed asset. Gain on sale. Debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and credit the gain on sale of asset account.

Q. What is decommissioning of assets?

Similarly, the decommissioning cost is the cost incurred by the companies to reverse modifications that were made in setting up in the landscape. This means the asset is used up and set for sale or salvage. Decommissioning costs are also popularly called asset retirement costs.

Q. What is asset retirement SAP?

Asset retirement is the removal of an asset or part of an asset from the asset portfolio. An asset is sold, resulting in revenue being earned. The sale is posted with a customer. An asset is sold, resulting in revenue being earned. The sale is posted against a clearing account.

Q. How does SAP calculate asset retirement?

S_ALR_87012052 is a transaction code used for Asset Retirements in SAP.

Q. How do I retire an asset in SAP?

Asset Retirement with transaction code ABAVN

- To retire an asset go to Navigation: SAP Easy Access -> SAP Menu -> Accounting -> Financial accounting -> Fixed Asset -> Posting -> Retirement -> Asset Retirement by Scrapping.

- Alternatively: Transaction code ABAVN.

Q. How do you retire multiple assets in SAP?

Retire Multiple Assets in SAP

- Use AR01 (Asset balances report)

- Enter the assets to be disposed off and execute.

- Click on “Create Worklist” (Edit-> Worklist-> Create).

- Enter a name and click your selection.

- In the next screen, enter the data as you would in ABAVN.

- Go to AR31, use the work queue number and execute it.

Q. What is Fixed asset retirement?

Companies often remove fixed assets from service when those assets become obsolete because of physical (deterioration) or economic (technological innovation) factors. The remaining gross PP&E and accumulated depreciation of a sold asset are removed from the balance sheet. …

Q. How do you sell an asset without customer in SAP?

ABAON is used when you are retiring an asset and also entering a revenue. This is used when there is no customer involved. If you want to just scrap the asset i.e. it doesn’t generate any revenue, then use ABAVN. Enter the posting date, document date, asset date and any text.

Q. How do you post F 92 in SAP?

F-92 in SAP: Asset Sale to a Customer

- F-92 in SAP: Enter the Header Data on the Initial Screen.

- F-92 in SAP: Enter the Customer Details.

- F-92 in SAP: Enter the Fixed Asset Details.

- Asset Sale to a Customer: Post the Document.

Q. How do you find the net book value of assets in SAP?

If you want to see net book value of asset, then you can go for for asset explore T. Code – AW01N , there you give respective asset code and you can find out there net book value of asset or you can go for T. Code-AR02, here also same asset code and year, you have to give. You will be able to see net book value.

Q. How do you post asset sale with customer in SAP?

SAP Simple Finance – Asset Scrapping

- When you sell an asset, it results in revenue being earned. The sale is posted with a customer.

- When an asset is sold, it results in revenue being earned. This is posted against clearing account.

- You scrap an asset with no revenue earned.

- When an asset is sold to an affiliated company.

Q. How do you post an asset in SAP?

For depreciation from 01.01. 2019 to 28.02. 2019 will be posted in Ordinary Depreciation Posted. Enter Asset Class and Company code….

- Do not use OASV to upload Asset balance.

- Use ABF1L to upload Asset Balance.

- ABF1L can also be used to post entries in future.

- ABF1L allows to post entries in Asset Recon. Account.

Q. How do you post an asset entry in SAP?

Post To Cost Center in SAP

- Enter the Document date.

- Enter the Company code.

- Enter G/L Account for the Debit Entry which is to be posted to the Cost Center.

- Enter Debit Amount.

- Enter the Cost Center in which the Amount is to be posted.

- Enter G/L Account for Credit Entry.

- Enter Credit Amount.

Q. How do you sell a fixed asset in SAP?

Add a comment

- For fixed assets in Sales Order us a Service “Service for fixed asset selling” with price zero.

- Enhance Sales Order Items with an extension field of type fixed asset id.

- Add a Object Value Selector to this field to select fixed assets or a part of an fixed asset.

Q. What are 3 types of assets?

Different Types of Assets and Liabilities?

- Assets. Mostly assets are classified based on 3 broad categories, namely –

- Current assets or short-term assets.

- Fixed assets or long-term assets.

- Tangible assets.

- Intangible assets.

- Operating assets.

- Non-operating assets.

- Liability.