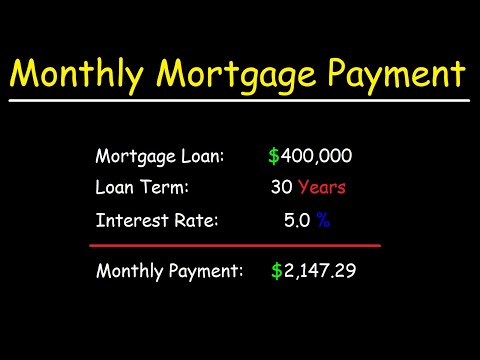

To figure your mortgage payment, start by converting your annual interest rate to a monthly interest rate by dividing by 12. Next, add 1 to the monthly rate. Third, multiply the number of years in the term of the mortgage by 12 to calculate the number of monthly payments you’ll make.

Q. Which option would you recommend to your friend about mortgages to save the most money?

Which of the following would you recommend to your friend about mortgages to save the most money? get the longest loan possible at the highest interest rate. get the shortest loan possible at the lowest interest rate. get the longest loan possible at the lowest interest rate.

Table of Contents

- Q. Which option would you recommend to your friend about mortgages to save the most money?

- Q. Why is credit card a the better option?

- Q. How do you calculate simple interest on a loan?

- Q. Is simple interest better than compound?

- Q. Is computed on the principal and added to it?

- Q. How long will an amount of money double at a simple interest rate of 2% per annum?

- Q. What does T represent in I PRT?

- Q. How do you fix I PRT problems?

- Q. What is the formula for I PRT?

- Q. What does T stand for in simple interest?

- Q. Why is simple interest important?

Q. Why is credit card a the better option?

Credit cards allow you to borrow money that must be repaid. Credit cards offer several advantages, including the chance to build credit and improved security measures. You get to the register and open up your wallet.

Q. How do you calculate simple interest on a loan?

A simple interest loan is one in which the interest has been calculated by multiplying the principal (P) times the rate (r) times the number of time periods (t). The formula looks like this: I (interest) = P (principal) x r (rate) x t (time periods).

Q. Is simple interest better than compound?

Compared to compound interest, simple interest is easier to calculate and easier to understand. When it comes to investing, compound interest is better since it allows funds to grow at a faster rate than they would in an account with a simple interest rate.

Q. Is computed on the principal and added to it?

Compound interest is computed on both the principal and any interest earned. You must calculate the interest each year and add it to the balance before you can calculate the next year’s interest payment, which will be based on both the principal and interest earned.

Q. How long will an amount of money double at a simple interest rate of 2% per annum?

50 years

Q. What does T represent in I PRT?

Investment problems usually involve simple annual interest (as opposed to compounded interest), using the interest formula I = Prt, where I stands for the interest on the original investment, P stands for the amount of the original investment (called the “principal”), r is the interest rate (expressed in decimal form).

Q. How do you fix I PRT problems?

Simple Interest Formulas and Calculations:

- Calculate Interest, solve for I. I = Prt.

- Calculate Principal Amount, solve for P. P = I / rt.

- Calculate rate of interest in decimal, solve for r. r = I / Pt.

- Calculate rate of interest in percent. R = r * 100.

- Calculate time, solve for t. t = I / Pr.

Q. What is the formula for I PRT?

Simple Interest means earning or paying interest only the Principal [1]. The Principal is the amount borrowed, the original amount invested, or the face value of a bond [2]….Simple Interest Calculator, I=Prt.

| Principal, P | |

|---|---|

| Annual Rate, r | % |

| Time, t | yrs + mo + |

| Days in Year | 360 365 |

| Interest, I |

Q. What does T stand for in simple interest?

R = interest rate (expressed percentage) T = time duration (in months or years) The Formula for simple interest is used to calculate the interest amount if time and the principal amount are known. In order the determine the total amount (A), the formula below is applied: Amount (A) = Principal (P) + Interest (I)

Q. Why is simple interest important?

Simple interest is calculated by looking at the principal amount borrowed, the rate of interest, and the time period it will cover. Simple interest is more advantageous for borrowers than compound interest, as it keeps overall interest payments lower.