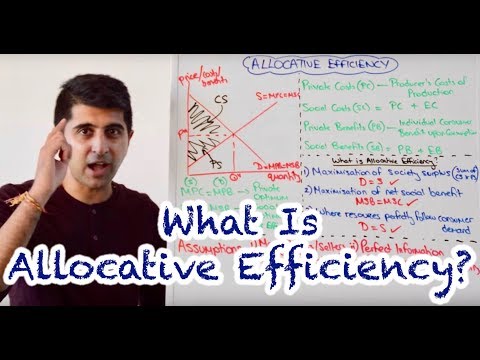

Definition of allocative efficiency This occurs when there is an optimal distribution of goods and services, taking into account consumer’s preferences. A more precise definition of allocative efficiency is at an output level where the Price equals the Marginal Cost (MC) of production.

Q. What conditions must be present for productive efficiency?

What conditions must be present for productive efficiency? Given available inputs and technology, it is impossible to produce more of one good without decreasing the quantity that is produced of another good.

Table of Contents

- Q. What conditions must be present for productive efficiency?

- Q. How allocative efficiency can be achieved?

- Q. How do you achieve dynamic efficiency?

- Q. Is perfect competition productively efficient?

- Q. Is perfect competition dynamically efficient?

- Q. Why is perfect competition used as a benchmark?

- Q. How does competition increase efficiency?

- Q. Which market structure is more efficient?

- Q. Who benefits from perfect competition?

- Q. What are examples of perfect competition?

Q. How allocative efficiency can be achieved?

Allocative efficiency is achieved when goods and/or services are distributed optimally in response to consumer demands (that is, wants and needs), and when the marginal cost and marginal utility of goods and services are equal. Allocative efficiency is also referred to as Allocational Efficiency.

Q. How do you achieve dynamic efficiency?

Dynamic efficiency may also involve implementing better working practices and better management of human capital. For example, better relationships with unions that help to introduce new working practices. Dynamic efficiency involves a trade-off. To invest in better technology may involve higher costs in the short run.

Q. Is perfect competition productively efficient?

Perfect competition is considered to be “perfect” because both allocative and productive efficiency are met at the same time in a long-run equilibrium. Only if P = MC, the rule applied by a profit-maximizing perfectly competitive firm, will society’s costs and benefits be in balance.

Q. Is perfect competition dynamically efficient?

Because there is a lack of investment, the firms may become static – there is no improvement in productivity and no reduction in costs over time; this makes them dynamically inefficient.

Q. Why is perfect competition used as a benchmark?

Perfect competition is THE efficiency benchmark because it does the following: 1. Firms achieve economic efficiency when they maximize profit by setting price equal to marginal cost. 2. Firms achieve technical efficiency by producing at the minimum efficient scale of the long-run average cost curve.

Q. How does competition increase efficiency?

Economic efficiency – competition will ensure that firms move towards productive efficiency. The threat of competition should lead to a faster rate of technological diffusion, as firms have to be responsive to the changing needs of consumers. This is known as dynamic efficiency.

Q. Which market structure is more efficient?

Intuitively, perfectly competitive markets seem the best equipped to manage this, since, in the long run, the absence of firms with market power and the availability of perfect information mean that price equals marginal cost (the condition for allocative efficiency) and production is capped at the point where average …

Q. Who benefits from perfect competition?

It can be argued that perfect competition will yield the following benefits: Because there is perfect knowledge, there is no information failure and knowledge is shared evenly between all participants. There are no barriers to entry, so existing firms cannot derive any monopoly power.

Q. What are examples of perfect competition?

Examples of perfect competition

- Foreign exchange markets. Here currency is all homogeneous.

- Agricultural markets. In some cases, there are several farmers selling identical products to the market, and many buyers.

- Internet related industries.